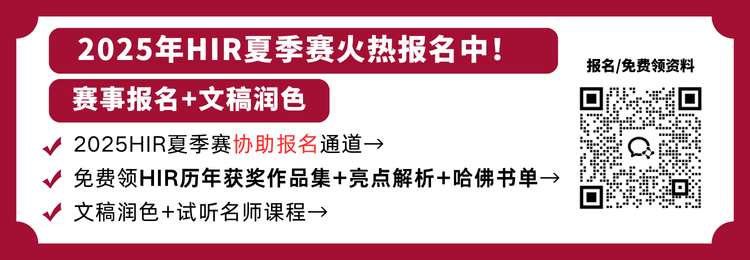

哈佛国际评论学术写作竞赛(HIR)由哈佛大学旗下权威期刊《哈佛国际评论》主办,创刊至今已汇集43位国家元首、11位诺贝尔奖得主及联合国秘书长等顶尖人士的深度评论。该竞赛面向全球9-12年级学生,旨在培养青年对国际事务的批判性思维与学术写作能力。获奖证书由哈佛国际评论官方颁发,成为英美名校申请中学术能力的重要佐证。

一、2025夏季赛核心主题解析

参赛者需从以下三题任选其一,完成一篇800-1200词的英文论文:

全球公域与共享资源管理

聚焦海洋、太空、大气等人类共有资源的治理挑战,需结合国际案例(如北极开发争议或跨境水资源分配)分析合作机制的有效性。

全球秩序变革中的新兴力量

探讨中国、印度、巴西等新兴经济体对国际政治经济格局的重塑,需对比历史案例(如RCEP协定)与当代供应链重组趋势。

韧性城市与未来城市发展

研究城市如何应对气候变化与人口压力,案例需具全球代表性(如新加坡智慧城市技术或非洲贫民窟改造方案)。

二、参赛流程与关键时间

注册截止:2025年7月25日(美东时间)

提交截止:2025年8月31日(美东时间)

决赛答辩日:2025年10月5日(线上举行)

注意:需通过官网完成缴费(单人1480元人民币)后提交作品;允许1-2人组队。

三、评审标准与奖项设置

评分维度(总分55分):

内容与选题(30分):主题关联性、论证逻辑性、案例与数据深度(需引用联合国报告等权威来源)。

风格与规范(25分):符合AP写作格式、文献引用规范(APA/MLA)、语言清晰度。

奖项等级:

金奖:全球前3%,作品与姓名官网公示,获两年期刊订阅权。

银奖/铜奖:全球前10%与前20%,官网公示姓名。

单项奖:高度表彰奖(High Commendation)、杰出写作内容/风格奖。

四、竞赛规则与学术规范

严禁使用AI工具:所有稿件经多重AI检测,高AI生成分数将取消资格。

引用要求:所有事实需标注超链接或按AP格式引用权威来源,禁止未经证实的观点。

全球视角:避免聚焦单一国家(如美国或中国),需体现跨文化比较分析。

五、决赛答辩与晋级机制

入围决赛者需参与线上答辩(15分钟),含以下环节:

10分钟陈述:提炼核心论点与研究创新性。

5分钟问答:回答哈佛评委提问,重点考察逻辑应变与跨文化理解力。

最终成绩由文章(70%)与答辩(30%)综合评定。

六、备赛策略建议

选题策略:

文科生可选主题A的人文治理维度,理科生可切入主题C的技术解决方案。

优先选择数据丰富的领域(如主题B的供应链案例)。

研究方法:

采用“问题-案例-对策”框架,例如分析东南亚红树林保护中的国际合作困境。

结合定量数据(如世界银行报告)与实地调研访谈。

写作优化:

引言需明确论点,结论提出可操作建议(如政策设计或技术应用)。

避免复杂句式堆砌,保持学术严谨性与可读性平衡。

2025年HIR夏季赛的革新主题与严格规范,为全球青年提供了剖析人类共同挑战的舞台。参赛者需立足实证、扎根全球视野,方能在这一顶级学术竞赛中脱颖而出。

HIR竞赛PDF版获奖作品集+备赛书单已整理好,扫码即可下载⇓